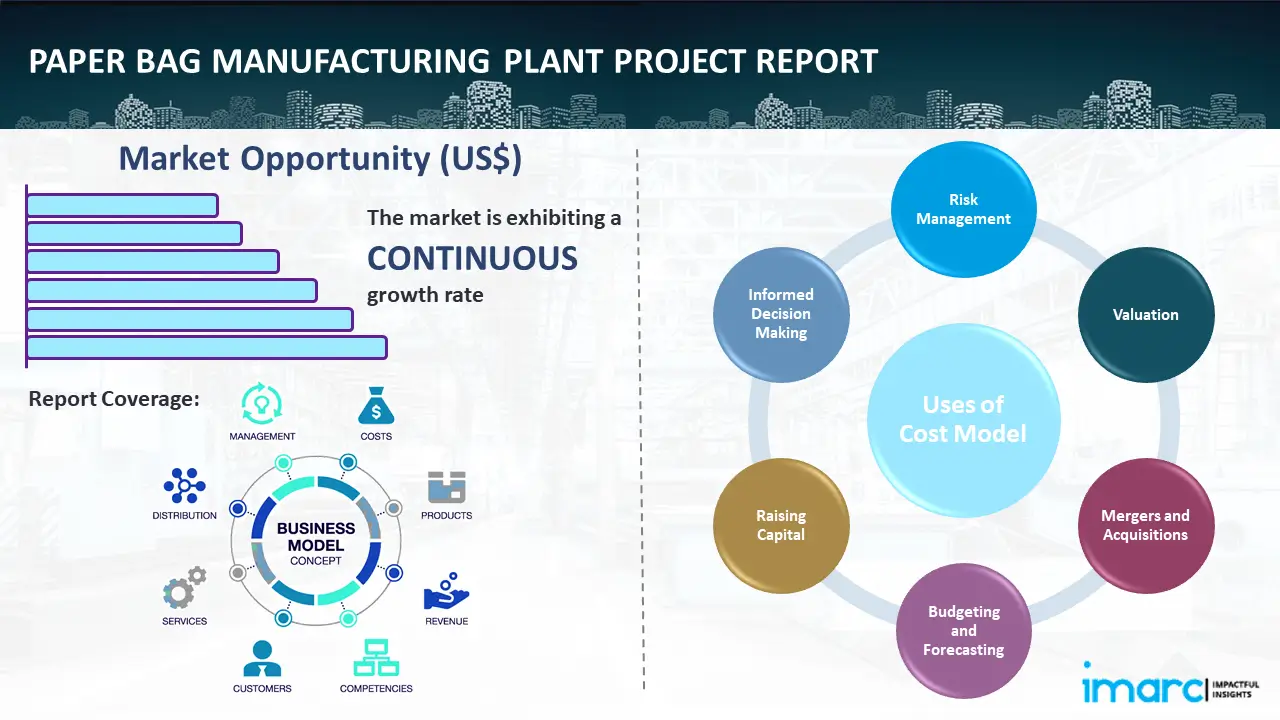

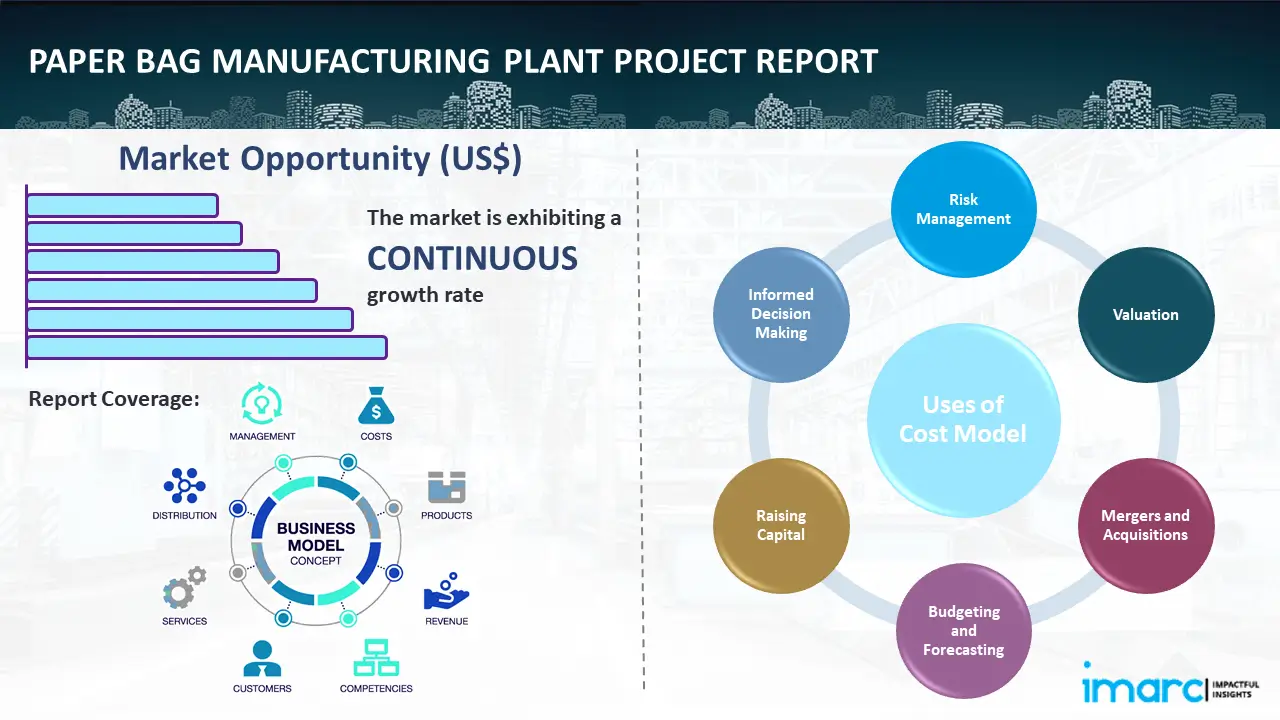

IMARC Group’s report, titled “Paper Bag Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue,” provides a complete roadmap for setting up a paper bag manufacturing plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc. The paper bag project report provides detailed insights into project economics, including capital investments, project funding, operating expenses, income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

The paper bag market is primarily driven by the implementation of stringent government regulations regarding the ban on single-use plastics. For example, the Central Pollution Control Board (CPCB), a federal agency under the Ministry of the Environment, launched a list of steps to be taken to outlaw specific single-use plastic products.

Similarly, the Qatar Municipality Ministry organized an introductory meeting on regulations of plastic bag utilization. In addition to this, the United Arab Emirates announced a ban on single-use plastic shopping bags to minimize air pollution levels.

Expanding Retail Industry

According to Alpen Capital, sales in the retail sector across the United Arab Emirates reached approximately US$ 74 Billion in 2021 and are anticipated to reach US$ 114 Billion by 2026. Companies are also launching paper bag barrier materials. For example, some of the outlets, such as Spinneys and Carrefour, in the Middle East have removed thicker traditional-type reusable plastic bags, thereby augmenting the demand for paper bags.

Apart from this, the increasing number of distribution channels, including hypermarkets and supermarkets, is further propelling the usage of paper bags. For instance, Lulu Group International invested US$ 2.9 Billion in its retail network, thereby opening 91 hypermarkets between 2020 and 2023.

Strategic Mergers and Acquisitions

Some of the key players operating in the paper bag market include Paperbag Limited, Novolex Holdings, Smurfit Kappa Group PLC, B&H Bag Company, Ronpak, and DS Smith Plc., among many others. They are focusing on business expansion via new product launches, mergers and acquisitions, collaborations and agreements across the value chain, etc. For example, Novolex launched innovative paper shopping bags, namely Load & Fold Shopping Bag and Load & Seal Shopping Bag, that offer more secure transport and deliveries for retailers and restaurants.

Moreover, JK Paper, one of the paper and packaging board companies, announced the acquisition of Securipax Packaging Private Ltd. and Horizon Packs Private Ltd. in stages for approximately Rs 578 Crore.

The market is also being driven by increasing investments and capacity expansions:

The following aspects have been covered in the paper bag manufacturing plant report:

The report provides insights into the landscape of the paper bag industry at the global level. The report also provides a segment-wise and region-wise breakup of the global paper bag industry. Additionally, it also provides the price analysis of feedstocks used in the manufacturing of paper bag, along with the industry profit margins.

The report also provides detailed information related to the paper bag manufacturing process flow and various unit operations involved in a manufacturing plant. Furthermore, information related to mass balance and raw material requirements has also been provided in the report with a list of necessary quality assurance criteria and technical tests.

The report provides a detailed location analysis covering insights into the land location, selection criteria, location significance, environmental impact, expenditure, and other paper bag manufacturing plant costs. Additionally, the report provides information related to plant layout and factors influencing the same. Furthermore, other requirements and expenditures related to machinery, raw materials, packaging, transportation, utilities, and human resources have also been covered in the report.

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

.webp)

The report also covers a detailed analysis of the project economics for setting up a paper bag manufacturing plant. This includes the analysis and detailed understanding of paper bag manufacturing plant costs, including capital expenditure (CapEx), operating expenditure (OpEx), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis. Furthermore, the report also provides a detailed analysis of the regulatory procedures and approvals, information related to financial assistance, along with a comprehensive list of certifications required for setting up a paper bag manufacturing plant.

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX |

| Total Expenditure | US$ | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX |

| Net Profit | US$ | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX |

| Report Features | Details |

|---|---|

| Product Name | Paper Bag |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements |

Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs

Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout

Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request)

Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request)

Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request)

Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs

Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation

Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis

While we have aimed to create an all-encompassing paper bag plant project report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include: